2015 Third Quarter Market Review

The third quarter of 2015 was a period of extremes. It began with a bang and ended with a bang (though of a different sort) but the middle felt more like a whimper. Although it is increasingly difficult to characterize the overall market without dividing it into sub-markets, the summer did display certain overall trends. Here are several of the most significant:

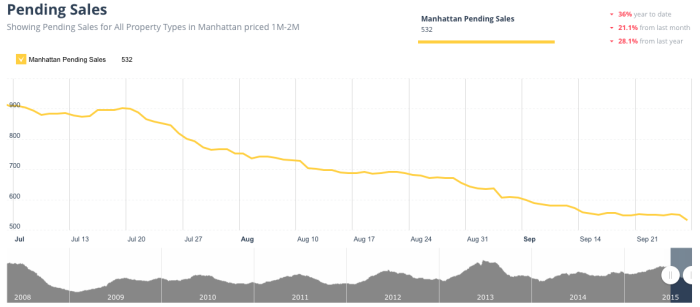

- In recent years Memorial Day Weekend has tended to herald the kick-off for a slow summer season. In 2015 we had the opposite experience. After a spring market which did not catch fire according to the historical template of spring markets, the market accelerated markedly in June and July. Both months confounded expectations with their strength, which saw already thin inventory absorbed rapidly in most market segments, especially at the $2 million and under price points and for those larger units whose pricing accurately reflected value. With buyers both anxious and cautious, they will fight for what they perceive to be a good deal while ignoring what they perceive as a bad one.

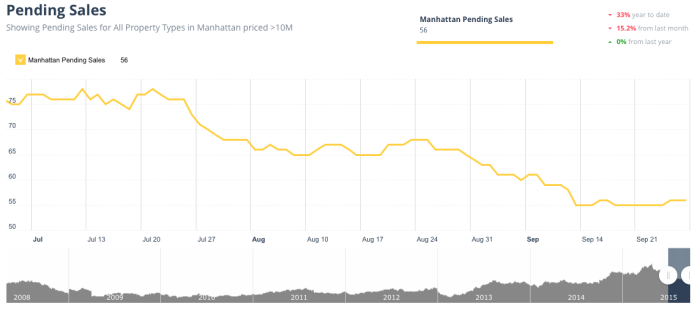

- The continuing exception remains the ultra-luxury market, in which the slow absorption seen in the year’s earlier two quarters continued and even slowed further. As of mid-September, in fact, one of our agents found 96 active listings in Manhattan for over $20 million. That’s a lot of expensive inventory waiting for an increasingly elusive buyer!

- In August the market slowed, which is not unusual. More New Yorkers are on vacation in August than the other summer months, and typically the last two weeks are one of the year’s slowest periods. This year the disruption in the stock market during the middle of the month grounded activity to a halt. Buyers in the middle of bidding pulled back and the market went dead for the balance of the month. Most buyers do not resemble Warren Buffet, who is “nervous when people are buying,” but likes “buying when people are nervous.” Most of us, much as we like to think otherwise, prefer to take fewer chances.

- Given the 10% drop in the stock market, and the seesaw effect of its still ongoing approach to stability, we had no idea going into our very late Labor Day weekend how the fall market was likely to kick off. Fortunately the stock market, bouncing back and forth around 16,500, no longer seems like the threat it did a month earlier, and September has been a very busy month. More inventory has entered the market these last few weeks than we saw at the beginning of either the winter or spring markets, and properties with value-driven pricing experienced multiple bids, not just for smaller units, but in the 6 to 9 room inventory as well. And most of those buyers who lost their zeal in August have regained it in September!

Charts by UrbanDigs

- The Chinese continue to be the most active foreign condominium purchasers, although, less ostentatious than the now vanished Russian buyers, they prefer to buy a number of units in moderate price ranges rather than the most expensive units.

- The Brooklyn market, which had seemed to lose some of its fire over the summer, came roaring back to life in September. One of our agents told me last week of bidding $200,000 above a $1,400,000 asking price for an apartment in Brooklyn Heights. She told me she had felt, based on the comps, that the asking price for this particular 2 bedroom was already full, but pressed her buyers to reach for it because inventory is so light. Amazingly, their bid, nearly 15% over the asking price, was not the winner. Bed-Stuy and Prospect-Lefferts Gardens seem to be two of the hottest neighborhoods, since both possess beautiful brownstone and limestone townhouse inventory and slightly more reasonable prices. But these prices literally seem to be increasing every week!

- Co-ops continue to represent the best value in the marketplace. Typically, both the asking prices and the non-abated monthly charges are lower, so they represent a particularly strong opportunity for longer-term buyers, whose tenures in their apartments will outlive the tax abatements in so many of the newer condos, which will then be taxed more heavily than their co-operative counterparts. We are seeing increasing numbers of foreign buyers expressing interest in, and sometimes even willingness to disclose financial information to facilitate co-op purchases. They see the relative value, especially in those buildings which permit pied-a-terre ownership.

Given our September experience, I anticipate a strong fourth quarter – which should lead to one of the market’s stronger recent years. The sector to watch in the months ahead will be that for units of $10-$12 million and up, be they townhouses, co-ops, or condominiums. This inventory continues to appear on the market at a faster rate than it is absorbed. Will prices decrease? Will many of the units be offered for rent, or pulled from the market? Stay tuned…