Frederick Peters

President Emeritus

As the fourth quarter of 2019 moves toward a close, the peaks and valleys which characterized the year in the New York City real estate market become even more visible in hindsight. Actually, there was only one peak, and quite a lot of valley! During the first quarter, the market struggled through paralysis to generate a few transactions during its last weeks; transaction volume accelerated enormously during the second quarter in anticipation of the increased Mansion and Transfer Taxes due on transactions closing after July 1. These last weeks of June were the 2019 peak, with closing agents managing 5 or 6 closings each day as everyone rushed to get their deal closed under the wire before hundreds of thousands of dollars were added to their transaction costs. The third quarter suffered accordingly; as all the deals anticipating the uptick in taxes had rushed to close before July, transaction volume plummeted. And now, looking back at the fourth quarter, the market has begun to approach stasis after a number of years of decline, with a larger number of $4 million deals than in any December in recent years (according to the Olshan report).

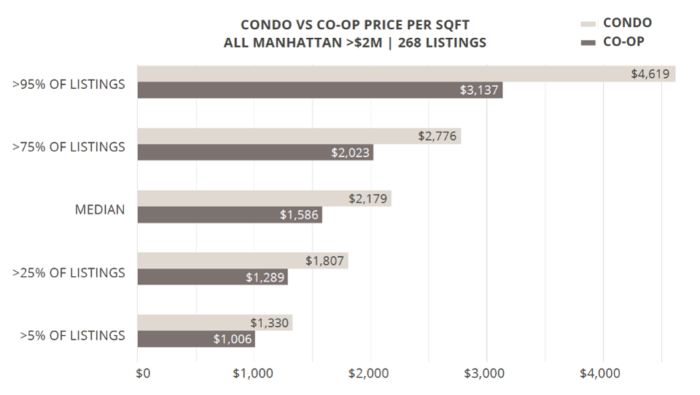

To be clear, the stasis gradually being achieved in the market is one of price, not volume. After peaking in 2015/2016, our market in Manhattan has seen price declines of between 15% and 25%, depending on unit size and neighborhood. Many prices, especially those of larger co-op units perceived as needing upgrades, are now at 2011 levels, as much as 25% below their highs of a few years earlier. Condo prices have undergone a similar fate, especially those at the mid- priced and higher ends above $5 million, although the decline is less precipitous at closer to 15%. This differential illustrates the increasingly clear gap between co-op and condominium values.

While condos certainly suffer from overbuilding, their convenience, multiple amenities, and ease of purchase contrast them ever more attractively with co-ops. Co-op Boards, inexplicably, have heeded none of the warning signs of declining comparative values. With their onerous Board package requirements, frequent Board rejections, and complex renovation rules, these co-op Boards increasingly drive potential purchasers into the arms of the new condominiums where renovation is not required, and owners can swim, work out, hold meetings, and dine – all without ever leaving the building. This rigidity on the part of Boards exacts a steep price from fellow shareholders, as co-op values continue to diminish relative to those of condominiums.

Source: Perchwell

As prices stabilize at lower levels, buyers have begun to re-enter the marketplace. This happens slowly, so while the fourth quarter was not strong in terms of either contracts signed or offers accepted, we do feel a thaw in the marketplace. As has been true for over a year now, the key to sales has been sellers’ acknowledgement of the change which has occurred. Buyers have long since ceased making offers on properties they perceive as overpriced. Although many sellers still find this hard to accept, others have learned that a property priced to market can actually sell promptly, with several offers. While it remains unlikely that any property will trade above its asking price, we have seen a number of sales in the fourth quarter where the trades have been at, or close to, asking prices which were clearly fair.

While many buyers throughout the market continue to hold back in the belief that the market has further to fall, evidence to the contrary is mounting. During Q4, my firm (Warburg Realty) has transacted a number of deals on properties which were many months on the market. Through a process of re-pricing and re-marketing, a number of these have sold at numbers appropriate to today’s realities.

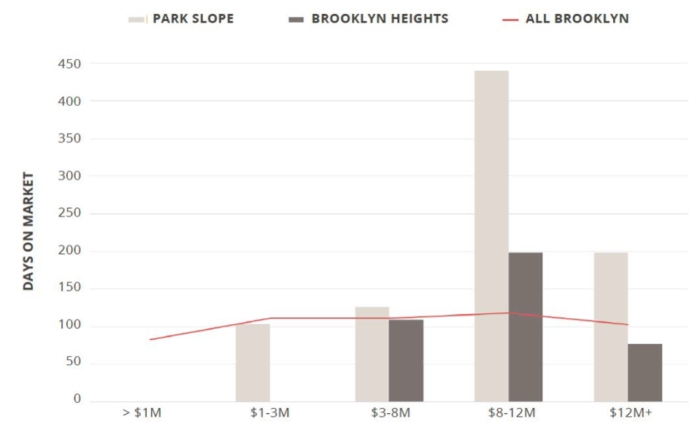

Greater demand and less inventory have mitigated the value loss in Brooklyn, although the downtown area still has its share of unsold condos. But as in Manhattan, overambitious pricing has been the enemy of the market. Especially in Park Slope and Brooklyn Heights, townhouses at precipitously high prices have languished even as smaller units and better priced houses have remained in demand.

Source: Perchwell

What do I anticipate for 2020? I anticipate a first quarter stronger than either the final quarter of this year or the first quarter of 2019. Prices will be lower but transactions should flow more smoothly throughout the marketplace. New resale inventory will arrive on the market in January and February, but not in enormous quantity. If the market does indeed continue to stabilize, more new listings will likely be placed on the market in the second quarter, and those which are priced well and staged attractively should sell within 30 to 60 days. The market will slow during the third quarter, as it does every four years, when attention to the Presidential race picks up. As for the fourth quarter, the Presidential election results will influence market stability in New York as it will across the country, though not necessarily in the same ways.

We live in interesting times. But even in interesting times we have to live somewhere. Opportunities abound in New York for those wise or brave enough to seize them. This quarter, the market began to turn. Remember, the bottom of the market is only ever perceptible once it has passed.

Q4 2019 Market Repor