Frederick Peters

President Emeritus

by

CEO and Founder Frederick W. Peters

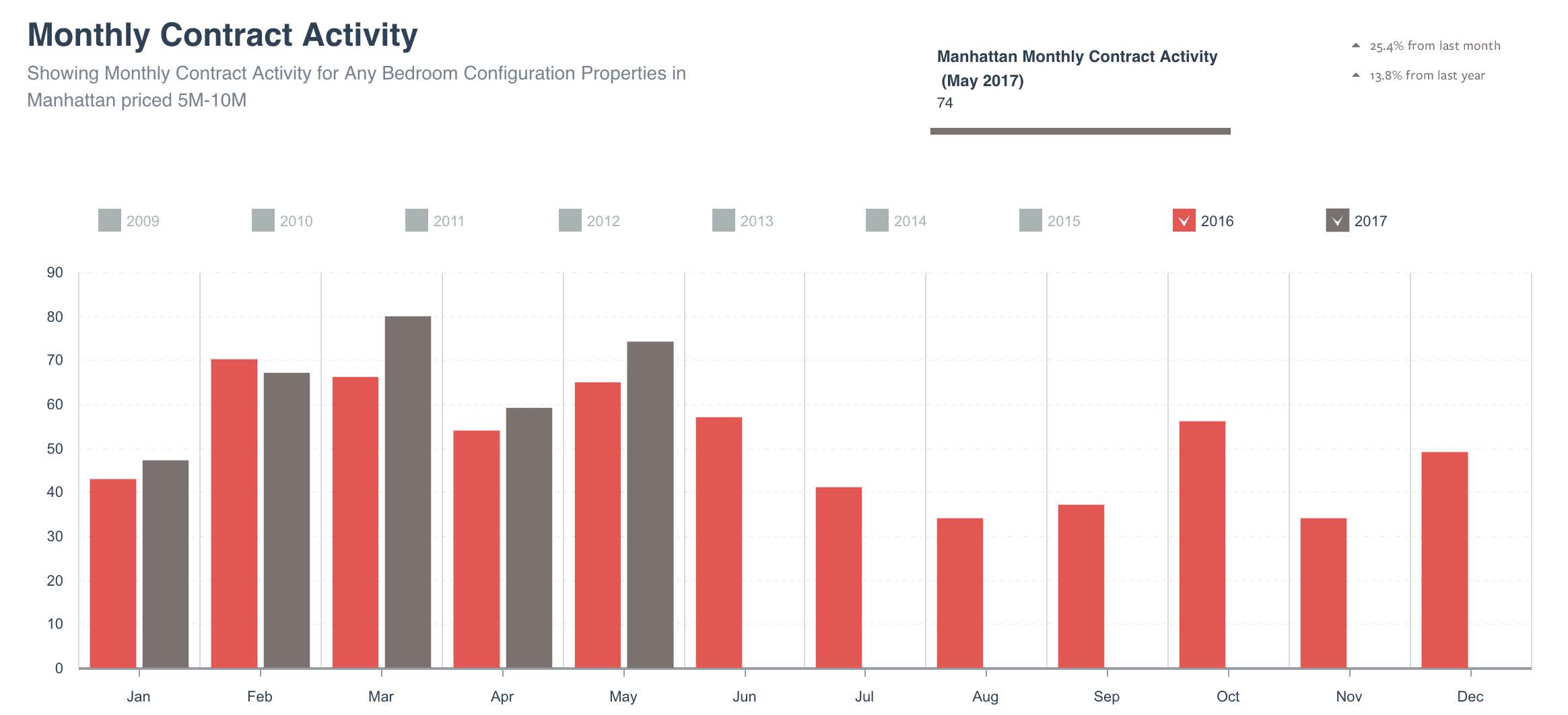

New York real estate saw both retrenchment and progress during the second quarter of 2017. Overall, the market between $5 million and $10 million fared better than it had in preceding months, while interest remained slower for higher priced units. Even many of the less expensive properties at $2 million and under have experienced more time on the market than before, as buyer velocity has slowed considerably.

Buyers have been both scarcer and slower this spring than in past years. While sales volume is not down dramatically, open houses have received far fewer visitors. New listings (and price drops) have generated far less interest in terms of the number of buyers brought out by these events. Luckily, many of these buyers have been serious. Most of the sales generated during this past quarter have resulted from the interest of a single bidder. Competitive bidding, while not entirely gone from the marketplace, has become an occasional response to extremely competitive pricing on the part of sellers.

Sellers finally seem more realistic in their pricing, whether initially or after a period with no activity at a higher price. Many Warburg sales during the spring season occurred because buyer interest was sparked by reduced prices, some dramatically so, for properties that had been on the market for months or even over a year. In today’s world, with both political anxiety and global safety concerns at high levels, our market cannot support aspirational pricing by sellers waiting for that “one buyer” who will overpay for their home. Buyers are as price conscious as I have ever seen them.

Today, most properties stay on the market longer and therefore, inventory is on the rise. Agents with a listing which is almost identical to another which sold quickly six months ago report that week after week they have few showing requests and no offers. And when an offer does come in, the buyer of today demonstrates little urgency. “I’ll respond after the weekend,” they say. Or, “We’re going out of town; if it’s still available when we get back maybe we will increase our offer.” If they do increase their offer, and a deal is struck, contract negotiations also proceed more slowly than formerly. The normal two week contract period now frequently lasts three or even four weeks. Again, no urgency-for the attorneys as well.

While markets have cooled in all price ranges, greater demand still propels the market for smaller units. Multiple bid situations still occur, especially in Brooklyn, for units priced under $1 million. Even in this marketplace, however, which has seen so much competition for well-priced units over the past 18 months, the pace has slowed considerably. Meanwhile, increasing numbers of younger consumers go north to Washington Heights or cross the bridges into Queens and the Bronx.

The rental market remains in the doldrums. Even as the summer months (which traditionally are peak season for rental units) begin, the pace at which new leases are signed has not appreciably picked up. Many tenants whose leases are expiring negotiate better deals for themselves, as landlords acknowledge that a known tenant at a slightly lower rent beats no tenant at all. The issue remains the same as it was last quarter: continued closings on condos bought for investment which then crowd into an already glutted, oversupplied rental market.

Overall, we are in what I like to call a broker’s market this quarter. Buyers and sellers see value differently, and it is up to agents to reconcile their viewpoints to bring a deal together. While challenging, these markets tend to provide fair prices for sellers while offering value opportunities for buyers. With more data than ever available to support our deep intuitive understanding of market direction and relative value, brokers work to adjust expectations and remind buyers and sellers of the ultimate goal: the purchase or sale of the property. Shifting or uncertain markets always create value for someone. The challenge is knowing (or accepting advice) about when the deal has become good enough to make. That’s where we come in.

Press inquiries: pr@warburgrealty.com