Frederick Peters

President Emeritus

The third quarter demonstrated beyond any doubt that we have moved into a buyer’s market. As the media began to focus on the increase in unsold inventory not just in the new development market, but also in resales, buyers became emboldened. Offers 20% and 25% below asking prices began to flow in, a phenomenon last seen in 2009. Some of these offers were even made on properties which had taken interim reductions from their original asking prices. While few sellers struck deals at those radically reduced offer prices, they signal a major shift in our marketplace, one which has been building for at least 18 months.

As always in our marketplace, different neighborhoods and price segments have experienced the change to different degrees and in different ways. The top quartile of the market actually experienced an uptick in deal flow, albeit at reduced prices. In every market compromise occurs between those sellers who are motivated to sell and those buyers needing to buy. Over the summer those buyers carefully calibrated their offers to reflect the market as they saw it, and serious sellers, albeit with some grumbling, accepted the new realities. Our agents struck these deals at prices anywhere between 7% and 12% below equivalent sales from a year before.

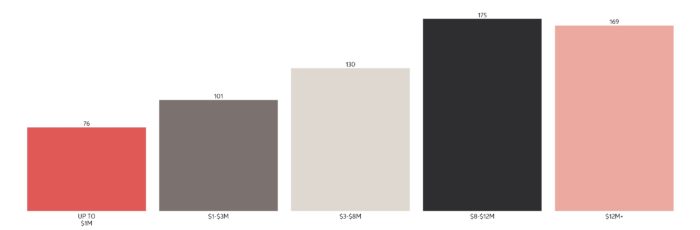

It remains true that clearly overpriced units excite neither foot traffic nor offers. Time and again we find that a price reduction below the next major threshold (from $839,000 to $799,000, for example, or from $4,795,000 to $4,495,000) inspires attention and, hopefully, bidding. But throughout the market we caution sellers not to expect multiple offers any more. In today’s market, the majority of deals result from a single offer. And we caution not to expect that it will be quick. The days on market average has soared during 2018.

Showing 2018 Average Days on Market By Price Segment | NYC Overall

Source: Perchwell

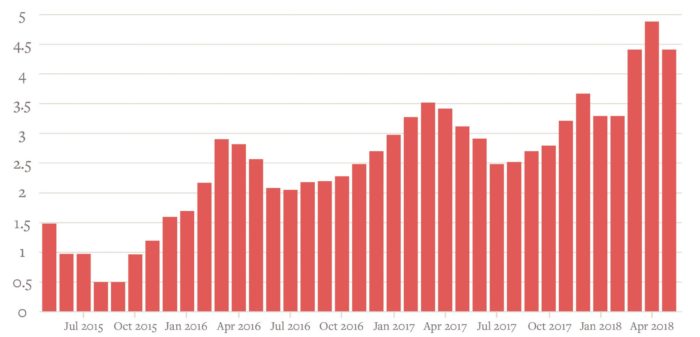

Of course, there are exceptions. Apartments in great condition may still get several offers if priced correctly. The $2 million and under market in Brooklyn remains hot, although the meaning of “hot” has changed: prices have stopped rising (they may even have receded a little) and the property which brought ten offers 18 months ago may now bring three. A recently listed property of ours on the Upper West Side received two offers in the first two weeks; that said, the higher of the two was still 15% below the asking price. These days, serious sellers understand that, if they have priced their properties right, a deal struck at 8% or 10% below ask may be a fine outcome. The following chart shows the rise in the difference between asking prices and selling prices since the height of the market in 2015.

Showing Median Listing Discount | Manhattan Overall

Source: UrbanDigs

Unusually, the rental market has not benefited from this lapse in sales. Here too there has been oversupply, as so many of the condominiums bought as investments over the past few years compete for renters. Residential lease renewals tend to be at lower prices than those at which the last lease was signed, and there may be a few months of vacancy before new tenants are found. As in the sales market, tenants sense that they have the upper hand.

What of the months ahead? Despite the soaring stock market, New Yorkers remain concerned about the future, both economic and political. Real estate functions as a commodity, its prices set by the laws of supply and demand. As long as supply outstrips demand, which it will certainly continue to do through the end of 2018, no price appreciation will occur. What I anticipate for the balance of the year is a stabilizing market in which buyers and sellers become more aligned on price and absorption of the oversupply of inventory increases. Deal flow will increase as more sellers accept the current price realities and new, more moderate price benchmarks will be set. And the show will go on.